The PTO does amazing work, but as a 501c3 it must file annual ta

AdBlock Detected!

Thank you for reading & participating.

Spout Off is funded by advertising.

Please disable or pause your ad blocker to continue.

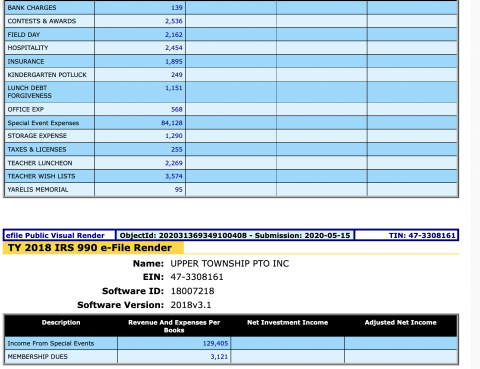

Upper Township - The PTO does amazing work, but as a 501c3 it must file annual tax returns to ensure transparency. The most recent filing from 2018 shows $132,526 in income from events and dues, with $84,128 spent on event costs and just $3,574 allocated to teacher wish lists. Boosterthon is a for profit company, returning only a portion of funds raised back to our school. The nonprofit Eagles Autism Foundation supports a cause that resonates with many families. The $7,000 raised for Autism won’t solve district-wide issues like buses or staffing, but updated PTO filings would build trust and accountability.

Print Publication Date:

12/04/2024